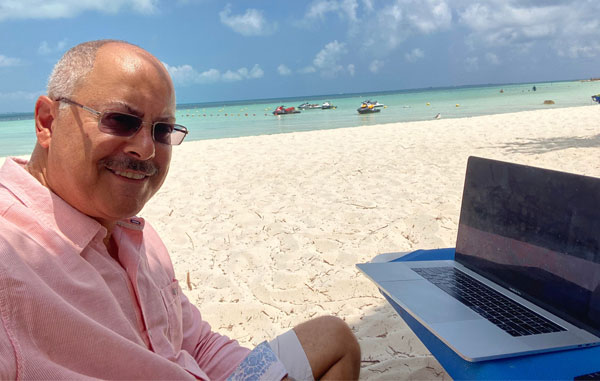

Grow Your Wealth Through Innovative Real Estate Investments With Cherif Medawar

Successful high end multi-million dollar residential transactions in San Francisco Bay Area

+

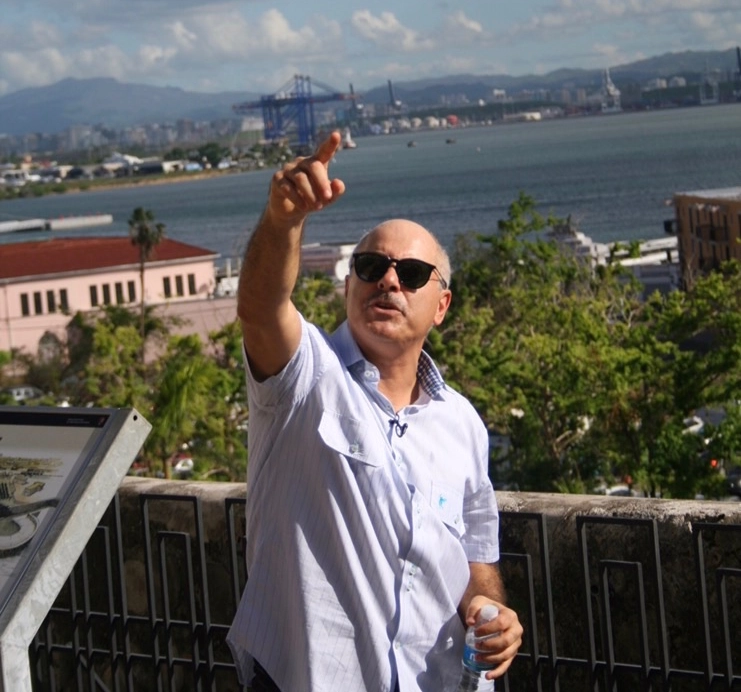

Commercial mixed-use properties in the United States and Puerto Rico

+

Years of steady reliable cash flow paid to investors (since 2009)

+

Assets under Management

$

M+